|

Is this email not displaying correctly? Click here to view in browser |

|

|

Dear Partner, Greetings from the Advocates Coalition for Development and Environment (ACODE). Welcome to IFFs Insights, curated from our work to promote financial transparency in Uganda. Our project, supported by the Government of Norway through the Global Financial Integrity (GFI), seeks to mitigate illicit financial flows and increase domestic resource mobilisation for development. The goal is to build capacities and enhance the mechanisms required to detect, prevent, and combat IFFs. It is envisaged that reducing IFFs will significantly bolster domestic resource mobilization, ensuring that funds rightfully remain within Uganda's borders and are efficiently utilized for national development priorities. Enjoy reading! |

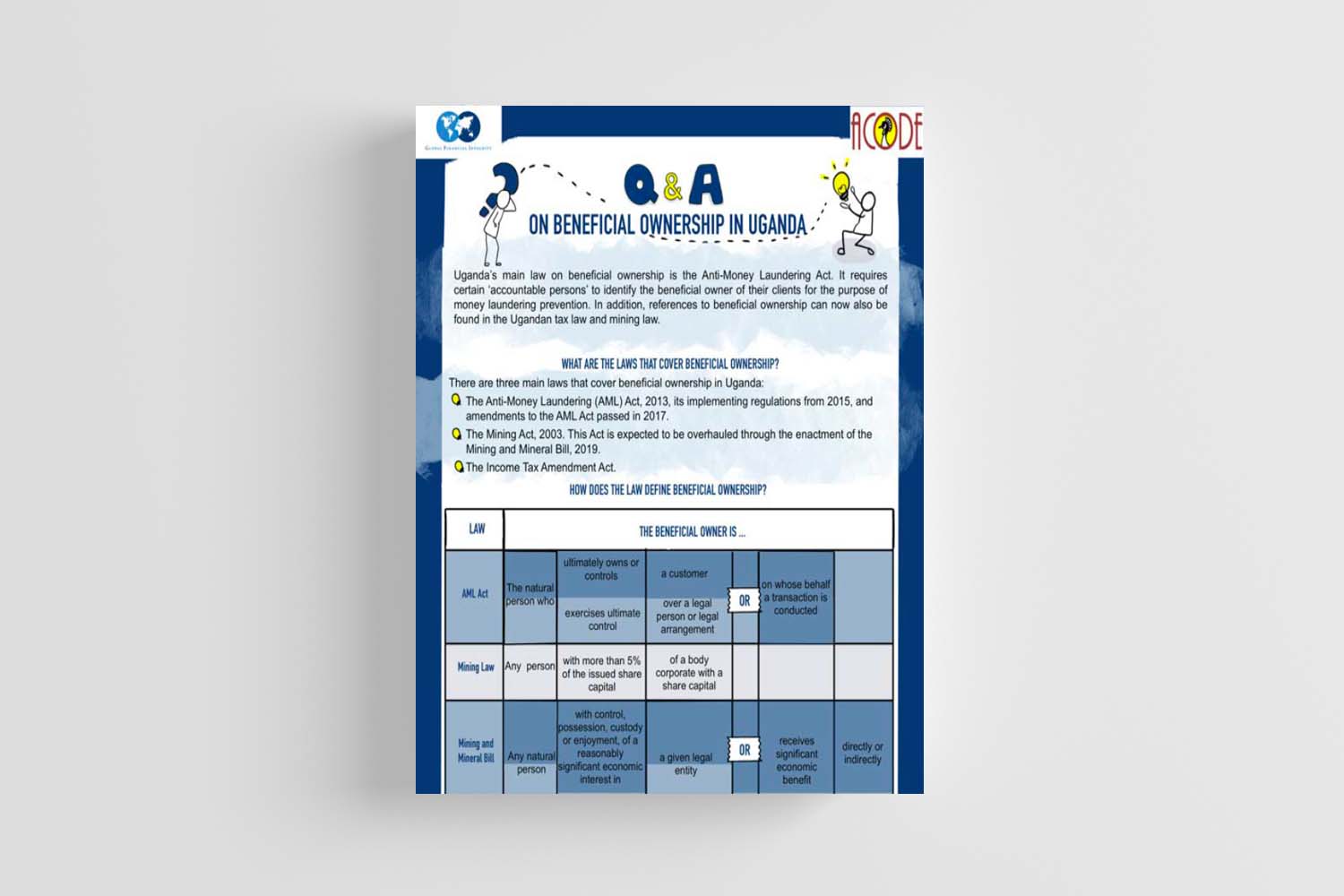

FAQs on beneficial ownership laws in UgandaFebruary 2020This infographic booklet contains frequently asked questions on beneficial ownership in Uganda. |

Gold Trade in UgandaPublished: 2022The mini-documentary show loses Uganda incurs on potential revenues from gold trade due to illicit financial flows and lack of transparency in the mining sector. |

|

© 2023 Advocates Coalition for Development & Environment. All Rights Reserved

Plot 96, Kanjokya Street. Box 29836, Kampala-UGANDA

|

|

Not wanting to receive these emails? You can unsubscribe here |