Issue 9 | April 18, 2020

Covid-19 Policy Considerations for Uganda’s National Budget

By Emmanuel Keith Kisaame | Research Fellow, @ACODE_Uganda

In December 2019 when the National Budget Framework Paper (NBFP FY 2020/21) was published, the world had barely heard of Covid-19 except for the reportedly stifled account of Dr. Li Wenliang (RIP). At the end of January 2020, this viral disease had not even been given an official name. Three months later and majority of the world is under lockdown with a potential economic recession looming. While it is understandable that the preparation of the NBFP FY 2020/21 took no Covid-19 considerations into account, it would difficult to understand if Uganda took no such considerations into account in its approved FY 2020/21 budget – especially now that Parliament is scrutinizing the draft budget. So what are some of these key considerations?

In December 2019 when the National Budget Framework Paper (NBFP FY 2020/21) was published, the world had barely heard of Covid-19 except for the reportedly stifled account of Dr. Li Wenliang (RIP). At the end of January 2020, this viral disease had not even been given an official name. Three months later and majority of the world is under lockdown with a potential economic recession looming. While it is understandable that the preparation of the NBFP FY 2020/21 took no Covid-19 considerations into account, it would difficult to understand if Uganda took no such considerations into account in its approved FY 2020/21 budget – especially now that Parliament is scrutinizing the draft budget. So what are some of these key considerations?

Uganda is now faced with a twin health and economic challenge which is likely to turn into a crisis, the longer the containment measures stay in place. Owing to the covid-19 related disruptions, Uganda’s Bank of Uganda has revised the country’s FY 2019/20 growth projections downwards, from 6% to about 3%. The Ministry of Finance Planning and Economic Development (MoFPED) projects that the country will register a revenue shortfall of about UGX 288.3 billion in Financial Year (FY) 2019/20 and UGX 350 billion in FY 2020/21. This however is the short term (6 -12 months period) outlook of the covid-19 effects. It is at the end of FY 2020/21 that we are likely to start seeing the long-term effects of covid-19 if they are not mitigated.

As countries lockdown borders to deal with containing the spread of covid-19, attention is now turning to what comes thereafter. The International Monetary Fund1 along with many other economists has projected an economic recession to follow – the OECD projects that global growth will slow down to about 2.4%. Attention is therefore turning to the design of economic stimulus packages, even before the virus is totally dealt with. Let us delve a bit more into the case of Uganda.

Fiscal year 2020/21 is set to be the inaugural year of Uganda’s third National development Plan (NDP III) under Vision 2040. The ultimate goal of NDP III is to “increase average household incomes and improve the quality of life of Ugandans”. In aligning the budget to the NDP, this same goal was adopted by the NBFP. Given the slowdown of economic activity due to the covid-19 pandemic, this is a fitting time for a budget to focus on increasing household incomes. It is perhaps the best way to avert the effects of a potential recession on a population.

Put simply, there are two approaches to increasing household income which have to work in tandem. One is to ensure an increase in earnings which entails measures such as creating jobs as well as securing markets for industrial and agricultural production. The second approach is to reduce catastrophic social expenditure by households especially on health. Catastrophic expenditure refers to any form of expenditure on a given need (such as health) that takes up a very large proportion of a household’s income (usually over 40%), leaving little or nothing to cater for other subsistence needs of the household.

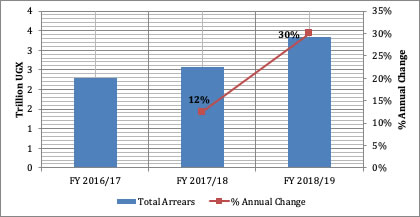

SLet us start at the top! The first step to mitigate the potential effects of covid-19 is to ensure that FY 2020/21 provides an economic stimulus without increasing the country’s debt burden. Here are a few thoughts on how this can be achieved. The MoFPED ought to clamp down on the accumulation and non-payment of government’s domestic arrears (money owed to government suppliers, pensioners, utilities etc). The Auditor General’s Report for FY 2018/19 indicates that domestic arrears stood at UGX 3.3 Trillion as of June 2019 and significantly rose from the previous fiscal year (see figure 1). A significant proportion of these arrears remain outstanding considering that the fiscal framework only indicates UGX 449.5 Billion and UGX 400 Billion allocated to arrears in FY 2019/20 and FY 2020/21 respectively.

Figure 1: Trends in Domestic Arrears between FY 2016/17 and FY 2018/19

Source: Computations based on the Report of the Auditor General FY 2018/19.

Source: Computations based on the Report of the Auditor General FY 2018/19.

Arrears constrain business operations for government suppliers and also threaten livelihoods of the pensioners – many of whom are entirely dependent on their pensions as the main source of income. Therefore one sure way of increasing household income is to ensure that businesses that are owed money are paid and outstanding pension payments are honoured. One potential source of funds to increase the budget for arrears could be the reallocation of some of the public administration expenditure. Expenses such as travel (inland and abroad) which account for UGX 652.8 Billion in the budget can be reduced significantly to avail more funds for the health sector and clearing domestic arrears. When considered together with Carriage, Haulage, Freight and transport hire expenses; this amount rises to UGX 815 Billion. In the immediate post covid-19 period (between now and December 2020), it is hard to envisage countries entirely abandoning the travel restrictions in place due to the risk of re-infections. It is therefore hard to justify the 21% increase in the travel budget relative to the FY 2019/20 levels. The proposed reallocation of funds is essential in FY 2020/21 to counter the projected fall in revenue owing to a reduction in imports and the volumes of business transactions between now and December 2020.

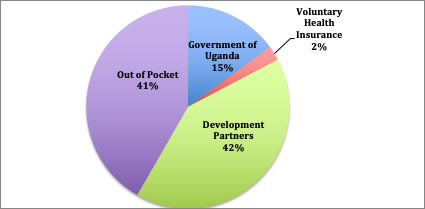

Additionally, with many households facing challenges of reduced incomes due to the lockdown and reduced economic activity, the other key consideration is to reduce out-of-pocket expenditure especially on health. In Uganda, out-of-pocket expenditure on health, accounts for 41% of total Health financing (see figure 2) second only to the contribution from the development partners. For most households, this expenditure is catastrophic in nature and, more than likely, contributes to many households either slipping into poverty or being vulnerable to poverty. In the post covid-19 budget, it is therefore important to consider financing measures to reduce out-of-pocket expenditure to its lowest levels (less than 10% of total expenditure on health). The foregone expenditure on health will leave households with income that can be put to other subsistence needs such as food – especially because the measure of government distributing food to vulnerable households is simply not sustainable in the long run. The foregone expenditure on health could potentially also leave households with more resources to save, accumulate capital and invest in their medium or small scale enterprises which are often constrained by limited capital.

Figure 2: Share of Current Health Expenditure in Uganda

Source: Computations from the Ministry of Health’s National Health Expenditure Report, 2018

Source: Computations from the Ministry of Health’s National Health Expenditure Report, 2018

There are two ways to reduce out-of-pocket expenditure on health. The first measure is to increase funding for the health sector especially for Primary Health Care as well as the essential medicines and health supplies. These two expenditure items are bound to have major funding gaps despite the 5.7% increase in the health sector budget relative to the FY 2019/20 levels. The second measure to reduce out-of-pocket expenditure on health would be the establishment of the proposed National Health Insurance Scheme (NHIS). The NHIS which has been planned for several years now is envisaged to increase financing for health care in the country while also increasing access to healthcare for most households.

The third consideration to take into account is for government of Uganda to put in place measures to enhance agricultural income, since majority of households in the country rely on agriculture as their main source of livelihoods. Key to this is value addition which is the thrust of the agricultural sector budget in FY 2020/21. In line with this, government also needs to secure more export markets for our agricultural produce beyond the East African region. The post covid-19 world is going to need a lot of food which is an opportunity for a country like Uganda where covid-19 has not affected agricultural production.

Finally, it is my considered opinion, that Uganda is well placed to weather the effects of the looming economic recession. This is by no means a consequence of meticulous economic planning but mostly due to the country’s climate and weather. Yes the economy will contract, but this is unlikely to last far beyond December 2020. This is simply because the covid-19 pandemic has spread in period of abundant rainfall in the country that is heavily reliant on rain fed agriculture. As any keen observer of our GDP over the years will attest, the country’s GDP growth patterns and trends mimic the trends in our Agricultural sector growth. When food is abundant in supply, inflation remains relatively stable and so do other macro-economic variables of the country. However, it is also my considered opinion that if the considerations highlighted herein along with others pointed out by other policy commentators are not taken into account, we will not attain our desired goal of increasing household incomes and many households will fall on very hard times – many indeed will slip into poverty and so will the poverty gap grow.

Footnote Reference

-----------------------

1 https://www.imf.org/en/News/Articles/2020/03/23/pr2098-imf-managing-director-statement-following-a-g20-ministerial-call-on-the-coronavirus-emergency

|

|

+256 312 812 150 | Leave a comment | Center for Budget and Economic Governance

Subscribe To Our News Letter | Edit Subscription | Unsubscribe