Issue 10 | June 1, 2020

How the USD 491.5 Million IMF Loan to Uganda will be Utilized

By Ms Clara Mira, IMF Country Representative | @ACODE_Uganda

On May 6, 2020, the IMF Executive Board approved a disbursement of USD 491.5 m for emergency assistance for Uganda to help Uganda respond to the Covid-19 crisis

On May 6, 2020, the IMF Executive Board approved a disbursement of USD 491.5 m for emergency assistance for Uganda to help Uganda respond to the Covid-19 crisis

What is the RCF?

The Rapid Credit Facility (RCF) provides emergency financial support to low income countries facing urgent balance of payments needs. This instrument has been used in the past to respond to shocks and natural disasters. Currently, it is being used to channel the IMF’s emergency financial assistance to low income countries facing the covid-19 pandemic. The RCF’s terms and conditions are as follows: zero interest rate; grace period of 5½ years; and a maturity of 10 years. To date, about 100 countries have requested emergency financial assistance from the IMF, and nearly 60 have already received it—of which about 25 in Sub-Saharan Africa.

In view of the large needs faced by countries in the light of the covid-19 pandemic, the IMF has doubled the access limits (i.e., the amounts available) that can be borrowed under its emergency facilities. Accordingly, Uganda’s disbursement under the RCF is worth $491.5 million, equivalent to 100 percent of its quota, or SDR 361 million1.

What is the expected impact of the covid-19 crisis in Uganda?

The Ugandan economy is being severely impacted by covid-19. Growth projections are expected to nearly halve, from 6 percent growth projected for FY2019/20 to the current projection of 3.3 percent. Supply side disruptions, a sharp decline in both external and domestic demand due to the confinement measures to prevent the spread of the pandemic, and a sharp decline in remittances and FDI are expected to take a large toll on growth. The sectors more affected by the crisis include services (tourism, hospitality), manufacturing, construction and agriculture.

The social impact of covid-19 is also expected to be large. According to estimates from the Ministry of Finance, Planning and Economic Development, poverty could increase by as much as 2.6 million people. This could threaten Uganda’s impressive strides in poverty reduction observed over the last decade. The informal sector, refugees and women are particularly vulnerable. Therefore, it is essential to scale up well-targeted social protection interventions.

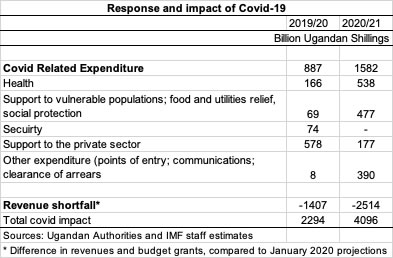

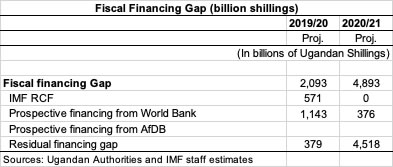

The fiscal accounts are expected to deteriorate significantly, driven by (i) lower revenues, which reflect lower economic activity and some relief measures, and could result in a shortfall of about Ush 1.4 trillion in FY2019/20 (1 percent of GDP); and (ii) higher expenditures in health, social protection, and private sector support areas, which could amount to about Ush 890 billion in additional expenditure in FY2019/20. As a result, and despite a significant under-execution of externally financed projects, the fiscal deficit is expected to increase from 5.5 percent last year to about 7.7 percent of GDP in the current fiscal year. Given available financing sources (not including the IMF), this would result in a fiscal financing gap of about Ush 2.1 trillion for FY2019/20, and about Ush 4.8 trillion next fiscal year.

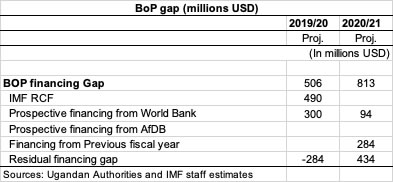

The external accounts are also expected to deteriorate. Relative to pre-crisis projections, remittances, FDI and tourism inflows are expected to be halved to about US$800 million, US$980 million and US$541 million, respectively. Exports are also expected to decline, though more moderately. As a small open economy, Uganda remains vulnerable to capital outflows. To maintain reserves at 3.5 or 4 months of the following year’s import coverage (considered necessary for macroeconomic stability), an additional external financing of about US$500 million would be needed for FY2019/20, and about US$800 million for FY2020/21 (before the IMF resources are considered).

What has been the Uganda authorities’ response to the Covid-19 socio-economic crisis?

The authorities have taken measures to respond to the health crisis and prevent the spread of the Covid-19. Other measures are aimed at mitigating the impact of the pandemic on the most vulnerable and the private sector. Key measures include:

- Additional health spending of about US$30 million has been approved, and this amount will need to continue increasing to reach US $125 million, the level needed over a six-month period according to the Ministry of Health’s response plan.

- Steps have also been taken to protect the most vulnerable, with ongoing food distribution campaigns and planned support to access to water and electricity. Additional spending is expected through enhanced social protection interventions, including targeted temporary cash transfers and cash for work schemes. Such interventions are essential to help cushion the severe impact of the crisis on the most vulnerable.

- Finally, steps have been taken to cushion the impact of the crisis on the private sector. Bank of Uganda has appropriately reduced its policy rate and introduced measures to support liquidity and allow the restructuring of loans, including by using a debt moratorium while preserving stability of the financial sector. Additional measures to be introduced include providing affordable credit through the Uganda Development Bank to companies that can produce useful items for the covid-response; the repayment of a larger than-budgeted amount of domestic arrears; tax deferrals and exemptions to affected sectors; and support to some sectors. A stimulus package is expected to be approved shortly.

The FY2020/21 budget will need to be adjusted to reflect the impact of these interventions and the lower expected available resources. Most likely, some reprioritization and postponement of non-essential expenditures will need to be agreed to ensure the budget can be fully financed.

What is the planned use of the resources?

The RCF resources are expected to contribute to fill both fiscal and external financing gaps. This would contribute to maintaining macroeconomic stability, including lower inflation, which is essential to protect the poor.

Taking into account the authorities’ needs and budget support operations expected from other development partners, the RCF’s expected use is as follows:

- about 70 percent, US$340 million, would support the balance of payments and thus build the country’s reserves in the central bank. Together with resources expected from other development partners, most notably the World Bank, this would ensure confidence and allow BoU to continue its good work of ensuring macroeconomic stability, which is key to ensure a more inclusive growth.

- the remainder, US$151.5 million would support the authorities’ response through the budget. The majority of the resources would support the private sector, through targeted, affordable credit channeled through the Uganda Development Bank. Remaining resources would be spent on health needs and social protection interventions.

What are the safeguards associated with the use of resources?

Transparency and accountability in the use of resources provided for the emergency response are critical to ensure that resources provided are used for their intended purposes. To that end, the authorities have agreed to: (i) report separately on the use of the funds to allow for accurate tracking of resources; (ii) publish all large procurement contracts2, together with the names of awarded companies and their beneficial owners, to prevent conflicts of interest; and (ii) undertake an independent audit of the crisis spending and publish its results. The audit will include an ex-post validation of delivery of the large procurement contracts.

Furthermore, the Uganda Development Bank is being placed under the regulation and supervision of Bank of Uganda, which would help strengthen its corporate governance and ensure it is monitored properly.

How is debt sustainability impacted by covid-19?

In our view, protecting lives and people’s livelihoods is the key priority in the current environment.

In any case, even if debt indicators will temporarily deteriorate, Uganda’s debt is expected to remain sustainable and at low risk of distress. The debt-to-GDP ratio could increase from 37.3 percent of GDP at the end of June 2019, to 45 percent at the end of FY2019/20, and peak at 59.6 percent in FY2023/24, before gradually coming down.

Once the crisis is over, it is expected that work will continue on implementing an appropriate fiscal framework, focused on enhancing Domestic Revenue Mobilization (including by implementing the recently approved DRM Strategy), and enhancing public investment management to ensure large infrastructure projects yield the expected growth dividend, with improved debt management. Ultimately, some fiscal consolidation is expected in the medium term as the large infrastructure scale-up is completed and oil starts flowing.

..............................

1The SDR is the IMF’s unit of account, a basket of currencies including 5 world key currencies: USD, UK pound, euro, renminbi, Japanese yen.

2Large contracts are defined as contracts above Ush500 million for works contracts, and above Ush200 million for goods and services ones.

|

|

+256 312 812 150 | Leave a comment | Center for Budget and Economic Governance

Subscribe To Our News Letter | Edit Subscription | Unsubscribe